Custom Private Equity Asset Managers Can Be Fun For Everyone

Wiki Article

All about Custom Private Equity Asset Managers

You have actually possibly listened to of the term private equity (PE): spending in firms that are not publicly traded. Approximately $11. 7 trillion in possessions were managed by private markets in 2022. PE firms look for opportunities to earn returns that are far better than what can be attained in public equity markets. There may be a couple of points you do not recognize concerning the market.

Exclusive equity companies have a range of financial investment choices.

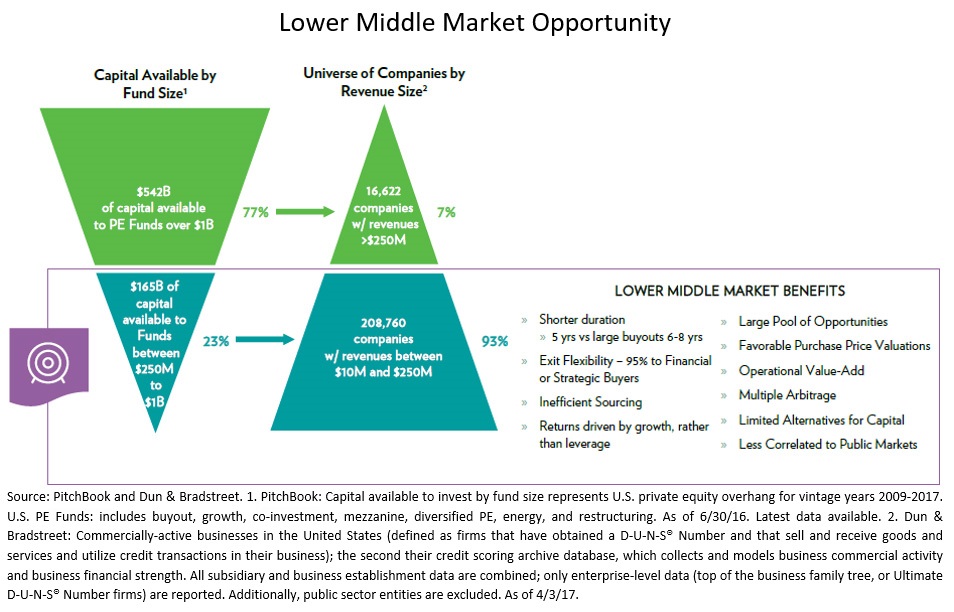

Since the very best gravitate towards the larger offers, the middle market is a substantially underserved market. There are a lot more vendors than there are very skilled and well-positioned finance specialists with extensive purchaser networks and resources to manage an offer. The returns of private equity are usually seen after a couple of years.

The 25-Second Trick For Custom Private Equity Asset Managers

Traveling below the radar of large multinational firms, most of these tiny companies usually offer higher-quality customer support and/or niche services and products that are not being offered by the large corporations (https://justpaste.it/7f9g7). Such advantages attract the rate of interest of private equity companies, as they have the insights and smart to manipulate such chances and take the company to the next level

A lot of managers at profile companies are offered equity and reward payment frameworks that reward them for striking their economic targets. Private equity possibilities are often out of reach for people that can not invest millions of bucks, but they shouldn't be.

There are regulations, such as limits on the accumulation amount of read this post here money and on the number of non-accredited investors. The personal equity business attracts a few of the most effective and brightest in corporate America, including leading entertainers from Fortune 500 firms and elite monitoring consulting companies. Law office can also be hiring premises for exclusive equity employs, as audit and lawful abilities are required to total offers, and deals are highly searched for. https://cpequityamtx.blog.ss-blog.jp/2023-12-05?1701784401.

A Biased View of Custom Private Equity Asset Managers

An additional downside is the lack of liquidity; as soon as in an exclusive equity transaction, it is not very easy to obtain out of or sell. With funds under management already in the trillions, private equity companies have come to be appealing investment lorries for wealthy individuals and institutions.

For decades, the features of exclusive equity have made the asset course an appealing proposal for those that can take part. Now that accessibility to personal equity is opening as much as even more private capitalists, the untapped capacity is ending up being a truth. So the inquiry to take into consideration is: why should you invest? We'll start with the primary disagreements for buying private equity: How and why personal equity returns have traditionally been more than various other properties on a variety of levels, Exactly how consisting of personal equity in a profile impacts the risk-return profile, by assisting to expand versus market and intermittent risk, Then, we will certainly describe some crucial considerations and dangers for exclusive equity investors.

When it concerns presenting a new asset right into a portfolio, one of the most basic factor to consider is the risk-return profile of that property. Historically, personal equity has displayed returns similar to that of Arising Market Equities and higher than all other conventional property courses. Its reasonably low volatility coupled with its high returns creates a compelling risk-return account.

Not known Details About Custom Private Equity Asset Managers

Personal equity fund quartiles have the widest array of returns throughout all alternative possession courses - as you can see listed below. Technique: Inner price of return (IRR) spreads out determined for funds within vintage years independently and after that balanced out. Median IRR was calculated bytaking the standard of the average IRR for funds within each vintage year.

The effect of adding exclusive equity into a portfolio is - as always - reliant on the profile itself. A Pantheon study from 2015 recommended that including private equity in a portfolio of pure public equity can unlock 3.

On the other hand, the very best personal equity companies have access to an even bigger pool of unknown possibilities that do not face the exact same examination, in addition to the resources to carry out due diligence on them and determine which deserve purchasing (Private Investment Opportunities). Spending at the ground flooring means greater risk, however for the firms that do be successful, the fund take advantage of higher returns

Getting My Custom Private Equity Asset Managers To Work

Both public and personal equity fund managers devote to investing a portion of the fund yet there remains a well-trodden concern with straightening passions for public equity fund monitoring: the 'principal-agent problem'. When an investor (the 'major') hires a public fund manager to take control of their funding (as an 'agent') they delegate control to the manager while retaining possession of the possessions.

When it comes to exclusive equity, the General Partner doesn't simply gain a management charge. They also make a percentage of the fund's profits in the form of "carry" (normally 20%). This ensures that the interests of the supervisor are lined up with those of the investors. Exclusive equity funds likewise mitigate another form of principal-agent trouble.

A public equity investor inevitably wants one point - for the administration to increase the stock rate and/or pay out returns. The financier has little to no control over the decision. We showed over the amount of exclusive equity approaches - particularly bulk acquistions - take control of the operating of the firm, guaranteeing that the long-lasting worth of the firm comes initially, raising the return on financial investment over the life of the fund.

Report this wiki page